For record keeping purposes, some account holders prefer them so that they could have a hard copy of their account details. In this case, the account holders receive them usually in a monthly frequency. There are two major faces or forms of a bank statement: You may also see Excel Income Statement Templates. Traditionally, they are printed and are sent to the designated account holders through mail or pickup in a financial’s institution local branch. Over the years, the face of a bank statement has also developed. You can also check out our Bank Statement Template and Income Statement Template samples we have. So what are you waiting for? Feel free to download and use our templates. Indeed, a bank account statement is the both the banks and account holder’s best friend.

It is a financial document that ensures the account holder that the bank observes utmost transparency and accountability in managing his or her account.If ever you are wondering what your balance is, it will be handy for you.It will also provide the account holder a summary of the cumulative effect of the transactions that transpired within a certain designated time.

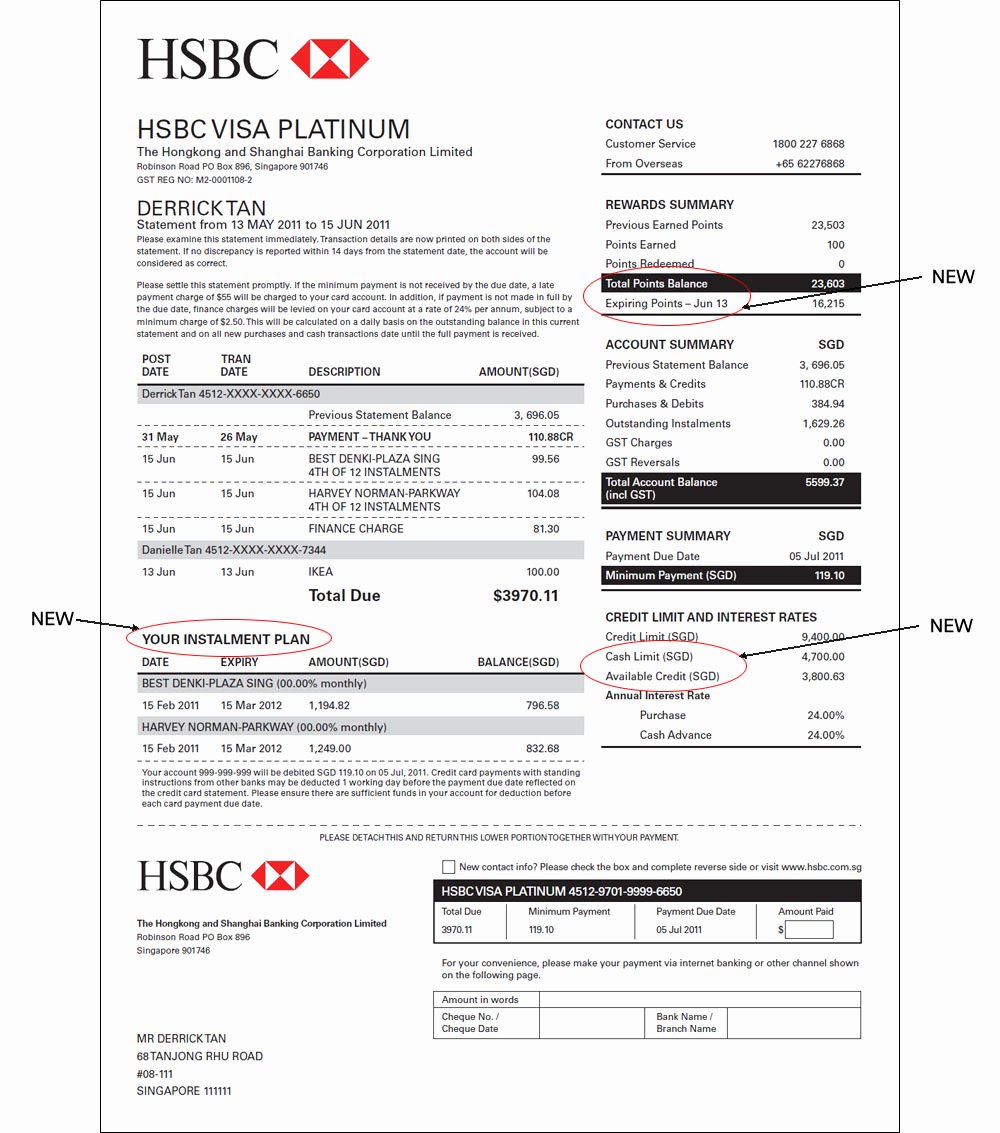

It will show the total withdrawals, interests earned, service charges, penalties, if there are any, and the deposits.Depending on the submission frequency, most banks give this to account holders in a monthly basis.Here are some salient points to remember about them: In the course of business, the bank will issue this document to a certain account holder which provides the ins and out of his or her account. Investopedia defines bank statement as “a record that summarizes all the transactions in an account throughout the time from the previous statement to the current statement.” You may also see Cash Flow Statement Templates.

Download Characteristics of a Bank Statement Templates

0 kommentar(er)

0 kommentar(er)